Bitcoin continues to rule the ever-changing world of cryptocurrencies. But what happens when the market seems to be in a quiet phase? Is this merely the storm’s eye? This blog explores why this calm could be the precursor to massive gains.

1. Understanding the Calm: A Breather or a Warning?

Bitcoin’s current stability might feel like a break from the usual rollercoaster ride of price fluctuations. However, this calm period isn’t just a random occurrence; it’s a natural part of market cycles.

Market Cycles Explained:

Markets often move in cycles—periods of rapid growth (bull markets) followed by slower, quieter phases (bear markets). The current calm could indicate that the market is consolidating, which means it’s gathering strength before making another big move. Think of it as the market taking a deep breath before the next sprint.

Market Cycles: The Natural Rhythm of Bitcoin’s Price

Bitcoin’s price doesn’t move randomly; it follows a cycle that includes periods of rapid growth, corrections, and stability. These cycles are driven by investor sentiment, market maturity, and external factors like regulation. The current calm might indicate that Bitcoin is in a consolidation phase, gathering momentum for the next significant price movement.

2. The Role of Market Sentiment: Fear, Greed, and Everything in Between

The state of the market is a major factor in how much Bitcoin fluctuates in value. Right now, the sentiment might seem neutral or even cautious. But as we’ve seen in the past, sentiment can shift quickly, driving prices up or down.

Example of Sentiment Shifts:

In 2017, Bitcoin’s price skyrocketed as FOMO (Fear of Missing Out) gripped investors. However, in early 2018, fear took over, leading to a sharp decline. Understanding sentiment is key to anticipating the next move.

The Role of Market Sentiment: Fear, Greed, and Everything in Between

Market sentiment is the collective emotion of investors, swinging between fear and greed. When greed dominates, prices often soar as investors rush to buy, driven by FOMO (Fear of Missing Out). Conversely, when fear takes over, prices can plummet as panic selling ensues. Understanding these emotional dynamics is crucial for predicting market trends. Right now, the balanced sentiment may be a sign of a market waiting for the next big catalyst.

3. Institutional Adoption: The Sleeping Giant

One of the most significant factors that could trigger the next storm of gains is institutional adoption. Big players like banks, hedge funds, and large corporations are increasingly getting involved in Bitcoin.

Why This Matters:

Institutions bring massive amounts of money into the market. When companies like Tesla and MicroStrategy announced their Bitcoin purchases, the price surged. If more institutions follow suit, it could lead to another major price rally.

Institutional Adoption: The Sleeping Giant

Institutional adoption refers to large-scale investments in Bitcoin by major financial entities like banks, hedge funds, and corporations. This “sleeping giant” has the potential to dramatically shift the market. When institutions invest in Bitcoin, they bring significant capital, credibility, and influence. This influx can drive up prices and encourage broader acceptance. As more institutions recognize Bitcoin’s value and incorporate it into their portfolios, we could see substantial market growth, transforming Bitcoin from a niche asset to a mainstream financial instrument.

4. Technological Developments: Building the Infrastructure for the Future

Bitcoin isn’t just a static asset; it’s a technology that’s constantly evolving. Upgrades and improvements to the Bitcoin network can have a big impact on its usability and value.

Key Developments:

– Taproot Upgrade: Improves privacy and the efficiency of complex transactions on the Bitcoin network.

These developments could make Bitcoin more appealing to both everyday users and large institutions, driving up demand and, consequently, the price.

Technological Developments: Building the Infrastructure for the Future

Bitcoin’s evolution is driven by continuous technological advancements, which are crucial for its long-term success. Additionally, the Taproot upgrade improves privacy and the efficiency of complex transactions. These developments strengthen Bitcoin’s infrastructure, paving the way for broader adoption and integration into the global financial system. As these technologies mature, they position Bitcoin as a more robust and scalable digital currency, ready for future growth.

-

Dynamics of Supply and Demand: The Halving Effect

Because there is a limit of 21 million coins in circulation, Bitcoin is a deflationary asset.. Every four years, the number of new Bitcoins created is cut in half, an event known as the “halving.”

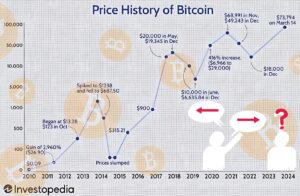

Historical Impact of Halvings:

– 2016 Halving: Price rose from $650 to nearly $20,000 in 2017.

– 2020 Halving: We’ve seen the price surge from around $9,000 to over $60,000 within a year.

This pattern suggests that halvings often precede significant price increases, making the current calm period particularly interesting.

Dynamics of Supply and Demand: The Halving Effect

The halving effect is a critical aspect of Bitcoin’s supply and demand dynamics. Approximately every four years, the reward for mining new Bitcoins is halved, reducing the rate at which new coins enter circulation. This built-in scarcity increases Bitcoin’s value, as a lower supply typically meets steady or rising demand. Historically, each halving has led to significant price surges in the following months. The anticipation of future halvings creates bullish sentiment among investors, making it a key driver in Bitcoin’s long-term price appreciation.

6. Market Indicators: What to Watch For

To navigate the storm, it’s important to keep an eye on key market indicators that can give you clues about what’s coming next.

Important Indicators:

– Volume: High trading volume can indicate strong market interest and potential price movement.

– Moving Averages: Watching the 50-day and 200-day moving averages can help identify trends.

– On-Chain Data: Metrics like Bitcoin’s hash rate and wallet activity can provide insights into network health and investor behavior.

Market Indicators: What to Watch For

Market indicators are essential tools for predicting Bitcoin’s price movements. Key indicators include trading volume, which reflects market activity and investor interest; moving averages, such as the 50-day and 200-day averages, which help identify trends; and on-chain data like Bitcoin’s hash rate and wallet activity, offering insights into network health and investor behavior. Monitoring these indicators can provide valuable clues about potential market shifts, helping investors make informed decisions in the volatile crypto landscape.

7. Investor Strategies: Preparing for the Storm

Knowing that a storm might be coming, how should you prepare?

Tips for Investors:

– Dollar-Cost Averaging (DCA): This strategy involves buying a fixed amount of Bitcoin at regular intervals, regardless of the price, to reduce the impact of volatility.

Investor Strategies: Preparing for the Storm

To navigate the volatile world of Bitcoin, having a solid strategy is essential. One effective approach is dollar-cost averaging (DCA), where you invest a fixed amount regularly, reducing the impact of market fluctuations. Diversifying your portfolio by including other cryptocurrencies or traditional assets can also spread risk. Additionally, staying informed and continuously learning about market trends, technological developments, and regulatory changes will help you make better decisions. Preparing now ensures you’re ready to capitalize when the next big market movement occurs.

– Stay Educated: The crypto market moves fast. Stay informed by following news, participating in online communities, and continually learning about the technology.

8. Looking Ahead: The Future of Bitcoin

The future of Bitcoin is full of possibilities. As more people understand its potential and more institutions adopt it, Bitcoin could become a central part of the global financial system.

Potential Future Scenarios:

– Bitcoin as Digital Gold: Bitcoin could become a global store of value, similar to gold, but more accessible and easier to transfer.

– Mainstream Adoption: With technological improvements, Bitcoin could be used more widely for everyday transactions, from buying coffee to paying for online services.

– Integration with AI and Blockchain: As AI and blockchain technologies evolve, Bitcoin could play a crucial role in decentralized finance (DeFi) and smart contract platforms.

Looking Ahead: The Future of Bitcoin

The future of Bitcoin is filled with possibilities as it continues to gain traction globally. As institutional adoption grows and technological advancements like the Lightning Network and Taproot enhance its usability, BTC could transition from a niche asset to a mainstream financial tool. Its potential to act as a global store of value, similar to digital gold, positions it as a key player in the evolving financial landscape. Additionally, integration with emerging technologies like AI and blockchain could further solidify BTC role in the future of finance, driving broader adoption and long-term growth.

9. Conclusion: Embrace the Calm, Prepare for the Storm

In the crypto world, periods of calm often precede significant changes. While BTC might seem quiet now, the potential for massive gains is looming on the horizon. By understanding the current state of the market, staying informed, and preparing strategically, you can position yourself to ride the storm and come out ahead.

Are you ready for what’s next in the world of BTC? The calm before the storm might just be the perfect time to make your move.

—

This structure gives your readers a comprehensive view of the current BTC landscape, what to watch for, and how to prepare for potential opportunities.

Conclusion: Embrace the Calm, Prepare for the Storm

The current calm in BTC price might seem uneventful, but it’s a crucial period of consolidation before potential significant movements. By embracing this calm and staying informed about market trends, institutional developments, and technological advancements, you position yourself to take advantage of future opportunities. Preparing with strategies like dollar-cost averaging and diversification will help you navigate the upcoming storm of gains, ensuring you’re ready to capitalize on BTC next big move.

Conclusion

BTC current calm might feel uneventful, but for those in the know, it’s a signal to prepare. With potential gains on the horizon, now is the time to stay vigilant, informed, and ready to act. Whether you’re a seasoned crypto enthusiast or just starting out, understanding the significance of this calm period could be your key to future success in the world of BTC.

Remember, in the world of crypto, the storm is where the real action happens. Are you ready